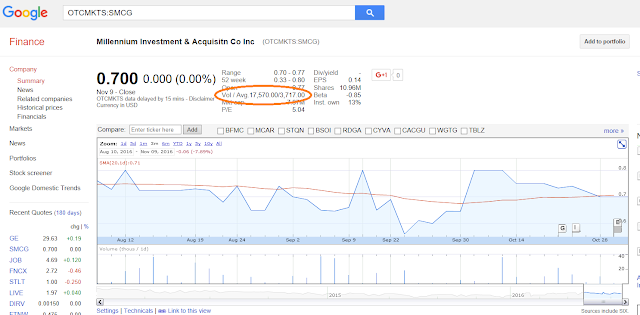

The amount of volume in any particular stock or penny stock is contingent on the demand for that stock. The more people that place orders to purchase the stock and the more people that are willing to sell the stock equates to more trades which is what creates volume in any given penny stock or micro cap company trading publicly. The volume of any given company is generally not an issue when you are talking about blue chip companies such as companies that are part of the Dow Jones or the S&P 500. These companies generally have enough demand and trading activity to make an investment in those stocks liquid. But when you are talking about penny stocks you must keep an eye on whether or not you will be able to sell your shares in the future.

Keep in mind that when you are looking at the average volume of any stock it is exactly what it says; an average. This means just because a stock has an average of 100,000 shares in volume does not mean that it is trading 100,000 shares a day. This could mean that it has traded 10,000 shares over 10 days or that it traded 100,000 shares in one day and then had no value at all for the other remaining three months of the average time period. Also keep in mind that the average is for the shares in a company and not the price. This means if you had an average volume of 100 shares and the stock was only worth one penny ($0.01) then the average volume in dollar amount is only $1. This means if you bought $1,000 of the stock then you would have trouble selling it since the demand over the average time was only $1 and there are not enough sufficient buyers in the marketplace to buy the stock when you want to sell it.

______________________________________________________________

About the Author: Nicholas Coriano is a Business Consultant. He is a graduate of The University of Connecticut Business School and the John Marshall Law School in Chicago. He has worked at Merrill Lynch, The New York Stock Exchange and is currently a partner at Cervitude Intelligent Relations, which specializes in Investor Relations for companies valued under $1 Billion USD.

About MicroCapCompany.COM: MicroCapCompany.COM (The Blog) is a blog focused on providing articles, news and information on the micro cap sector and start-ups. The Blog is a free service offered by Cervitude™ Investor Relations – a micro cap investor relations firm for micro cap companies and penny stocks. If there is a particular topic you would like to see covered on The Blog, email us. If you would like to advertise on The Blog, click here.